». After sending the report “Calculation of insurance premiums” to the FTS, the tax report can inform you about the error 0400400017 found in the report. The latter is accompanied by the message “The equality condition is violated ... ”. This is usually associated with the discrepancy between the indicator of the total annual amount and the amount for the first 9 months, to which the amount is added for the remaining 3 months of the year (4th quarter), revealed by the tax service. Let's see how to fix error 0400400017 when filing for insurance premiums.

The content of the article:

- Почему возникает ошибка при расчёте по страховым взносам 1 Why an error occurs when calculating insurance premiums

- Как исправить ошибку 0400400017 2 How to fix error 0400400017

- Заключение 3 Conclusion

Why an error occurs when calculating insurance premiums

Typically, this error occurs when submitting the report "Calculation of insurance premiums" to the appropriate department of the tax inspectorate. и от 29 января 2017 N ГД-4 11/27043@ о применении новых контрольных соотношений. The mass appearance of an error in the submitted reports dates from the beginning of 2018, which is connected with the letters of the Federal Tax Service dated January 13, 2017 No. DG-4-11 / 25417 @ and dated January 29, 2017 N DG-4 11/27043 @ about the use of new control ratios.

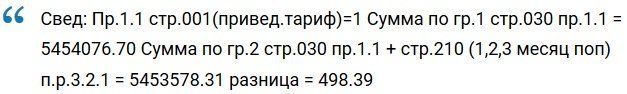

In addition to the aforementioned text of error 0400400017, the text of the message also contains an indication of the amount of difference detected by the automatic complex of the FTS, for example:

In this case, the amount in gr. page 030 (the sum of employee benefits for the whole year) is automatically compared with the amount specified in group 2, page 030 (sum of payments for the 4th quarter) + the value of column 210 for the previous period, usually 9 months. (usually pulled from the base of the FTS). If the program detects a difference, the accountant receives an error 0400400017.

If in column 1 the value is greater, then, probably, in previous periods, non-taxable allowance is not shown in section 3, column 210 (allowance for employees who are on childcare leave up to one and a half years). Previously, section 3 could not be filled for these employees, since benefits up to one and a half years are not subject to contributions to the FIU. When filing this report in column 1, the said non-taxable benefit can be taken into account.

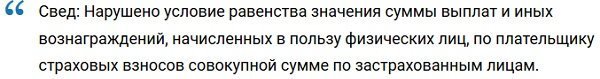

Also, the description for the error code 0400400017 may have a more abstract textual form:

Let's see how to solve the error when submitting reports.

This is interesting: error code 0000000002 - how to solve.

How To Fix Error 0400400017

The solution to error 0400400017 in the calculation of insurance premiums may consist in the implementation of the following points:

- . Once again, carefully and meticulously check all the data you submitted for relevance . The data submitted and accepted by the FTS are considered relevant, taking into account all the adjustments made;

- по недостающим сотрудникам в разрезе прошлых кварталов в третьем разделе; Make and submit to the tax adjustment for the missing employees in the context of past quarters in the third section;

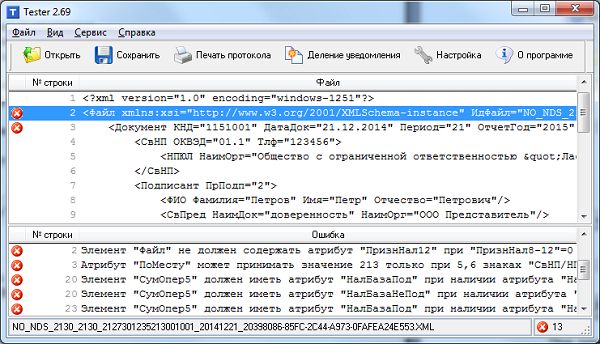

- . Use the Tester program to identify inconsistencies . Install the program on your PC, and check your performance with its contents. The program may contain a detailed description of the identified inconsistencies;

Use the program "Tester" to identify errors - . Call the tax office and consult your tax collector . If there is a certain amount of luck, they will point you to the causes of the error, and not get rid of common phrases and advice to solve the problem themselves.

If, after sending the correction, you get a negative protocol, you should not sound the alarm. You will have another 5 days to send corrections in which the identified nonconformity has been eliminated (Art. 431 TC). If, however, after the indicated 5 days the discrepancies are not eliminated, the enterprise may wait for a fine.

Also useful to know: error code 0400400011 - how to solve.

Conclusion

In our material, we have disassembled what the error code is: 0400400017 in the calculation of insurance premiums, and how it can be corrected. We recommend checking the indicators provided by the Tester program, identifying the essence of the discrepancy, and then sending a clarifying adjustment to the FTS. Direct tax service can also help. But in this case one should hope only for a happy coincidence of circumstances, since the tax inspectors themselves are often not aware of the specifics of all the problems arising in the reports.