When filing tax reports to the local tax inspectorate (Inspectorate of the Federal Tax Service), the responsible person may receive a notification about the refusal to accept these statements with the wording “The information on these persons does not correspond to (missing) the information available in the tax authority” error code: 0400500003 . In some cases, the “Not found SNILS” (“Insurance Number of the Individual Personal Account”) is added to this text. Usually this is due to a number of minor inaccuracies made by the person filing the statements (usually the chief accountant), and to the peculiarities of checking the accounting data in the tax authority itself. In this article I will tell you what is the essence of error 0400500003, what are its causes, and how to fix error 0400500003 on your PC.

The content of the article:

- Сведения по указанным лицам не соответствуют» как исправить – суть и причины ошибки 1 Information on the specified persons does not correspond "how to fix - the essence and causes of the error

- Как решить ошибку 0400500003 2 How to solve the error 0400500003

- Заключение 3 Conclusion

Information on the specified persons does not correspond "how to fix - the essence and causes of the error

As is known, in the tax sphere there is a “CLASSIFIER OF ERRORS OF FORMATIC AND LOGICAL CONTROL OF TAX AND ACCOUNTING FILES” (abbreviated as “COFO”), which contains a list of errors that may be made in the provision of tax and accounting reports.

In October 2016, a number of new errors were added to this classifier: error 0400400011 , including error code 0400500003 “The information on the specified persons does not correspond (are missing) to the information available to the tax authority”.

It usually arises in a situation where a number of SNILS of workers whose numbers are not in the Federal Tax Service database (Federal Tax Service) are indicated in the reporting, these employees have a different insurance number (SNILS), or in the case when the FIU transferred to the FTS incorrect databases (such also happens).

How to solve the error 0400500003

In accordance with the above, I recommend that you do the following:

- Recheck the accuracy of the reported data (check the data on the employees in the report, check the accuracy of the specified SNILS, quite often there are situations when the same SNILS are indicated for several people);

- Check the format of your submitted SNILS . Usually the specified format should be in the form: 000-000-000 00;

- And some accountants submit in the form: 000-000-000-00 - (the last line is superfluous);

- Remove the last line in the SNILS numbers, redo the reporting, and re-send the report to the IFTS;

- Contact your local UNFS (Federal Tax Service Administration) for advice and clarification in this matter. In some cases, the occurrence of this error was caused by the fact that the Pension Fund of Russia authorities transfer to the tax authorities incorrect databases that lack a number of necessary SNILS. In such cases, the NSF recommends that you just wait a few days until you get the correct bases and the system restores its normal operation;

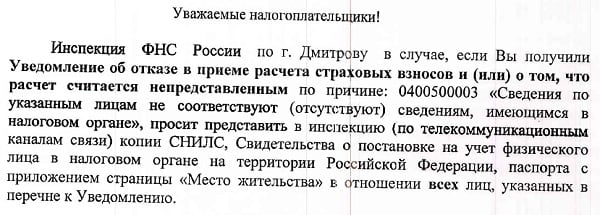

- In some cases, as in the following, the INFS to confirm the data will ask you to provide a copy of the SNILS , a certificate of registration of an individual, and a passport indicating the place of residence . After confirming the necessary information your report will be accepted.

Conclusion

Error 0400500003 arises in a situation when the submitted SNILSy reports are incorrect, their format is incorrectly recorded, or the FIU transferred incorrect databases to the tax authorities. Use the complex of tips listed by me, it will get rid of error 0400500003, thereby ensuring trouble-free reporting to the appropriate authorities.

( 8 ratings, average: 4.50 out of 5)

( 8 ratings, average: 4.50 out of 5)

I just wanted to say a big thank you for the article! Very helpful!

Every quarter I get a protocol with this error due to the lack of TIN from employees. I think it will last forever, because I can’t oblige employees to receive and submit this document.